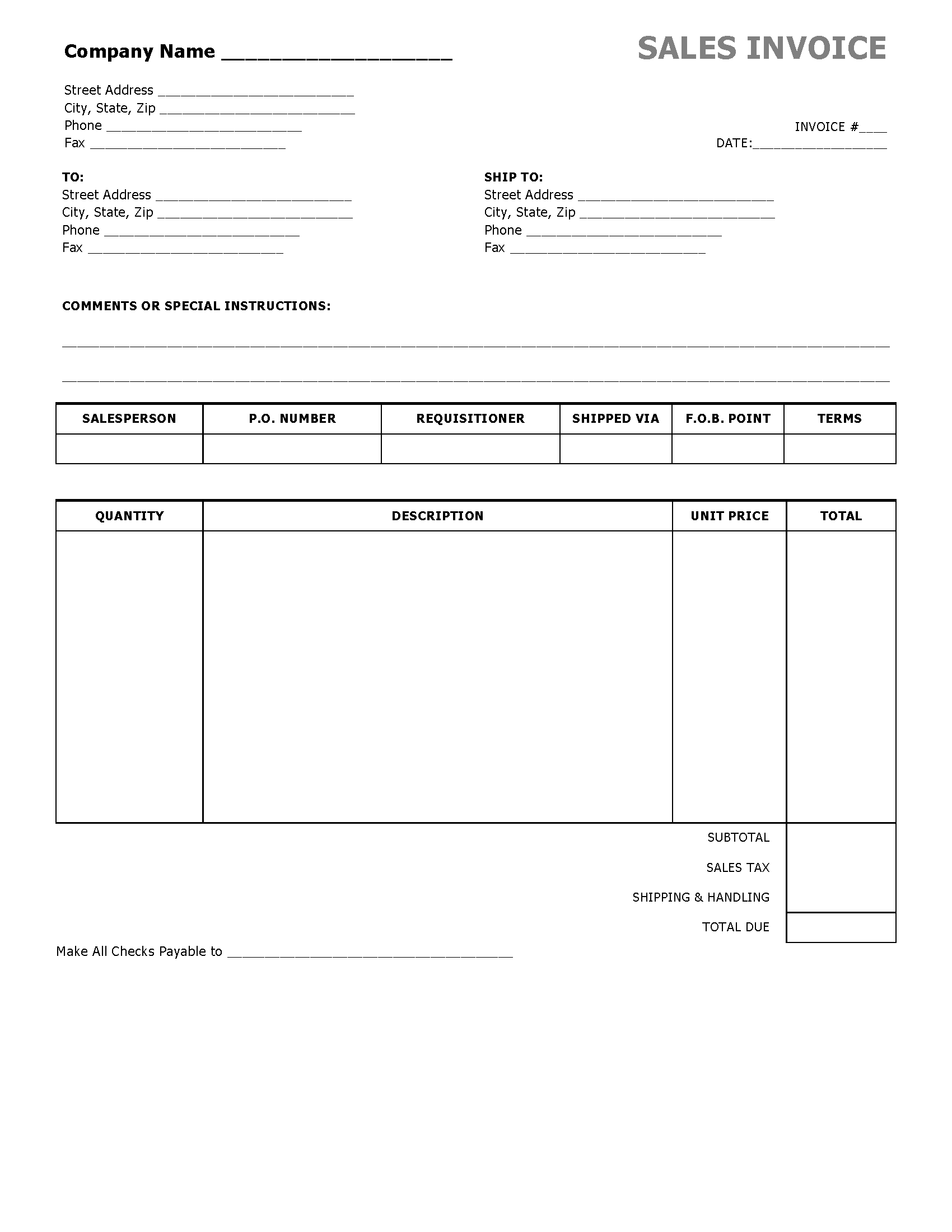

Sales Invoice Templates

The sales invoice templates are for any type of retail or private sale that involves property transferring from a seller to a buyer for payment or trade. The invoice lets the buyer know the amount of payment due, the due date for payment, proper payment method, and any other instructions needed to complete the payment. Sellers and buyers should keep copies of the invoice to record the goods shipped and received, and to complete their accounting records.